Rethink your customer experience; digitize your business models, and streamline your operations Offer a seamless and consistent interaction between customers and their financial institutions across all channels. Omni-channel leads to a successful Digital Bank

OMNI-CHANNEL FACTS

- Increase customer demands: any time, any place, on any device, across any channel

- Deliver information in real time across all touch points

- Digital transactions are cheaper

- Improve channels’ multiplication

- Improve customer acquisition by unifying digital banking experience

- Offer the right screen for the right task

- Enable faster customer service

- Reduce queuing time in branches

- Increase sales and satisfaction

- Decrease costs

- Gain staff productivity to focus on more complex matters

ENRICH CUSTOMER EXPERIENCE

Follow a customer centric approach through a unified digital banking experience. Deliver information in real time across all touchpoints any time, any place, on any device, across any channel

DIGITAL BANKING-CHANNEL CAPABILITIES

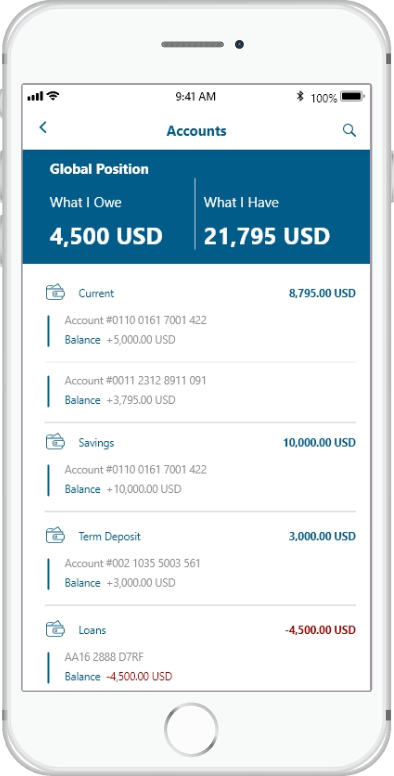

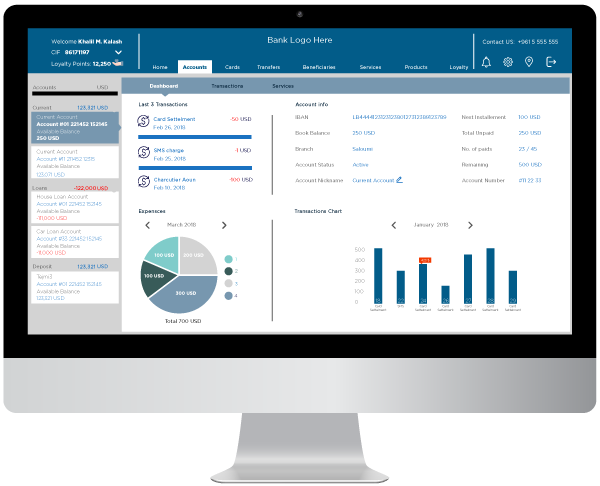

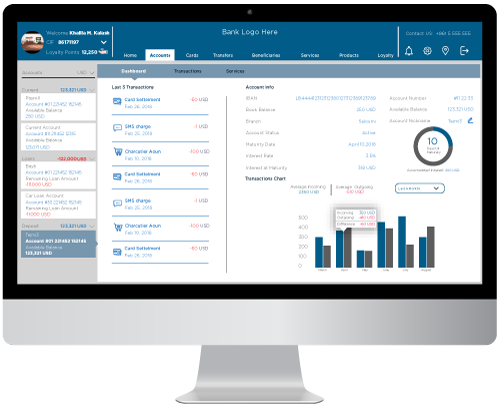

AGGREGATED DASHBOARD

- Recognize global position (what I owe, what I have)

- My Products aggregation

- Spending overview: categorization and comparison over the last period (same month last year, last 2 months)

- Incoming and outgoing transactions

DIGITAL ONBOARDING & ORIGINATION

- Digital onboarding enablement to improve operational efficiencies

- Easy KYC enablement – wizard based

- Fill your information – AML check

- Select a product (account, credit card, loan, etc…)

- Visit the bank for final signature

CIF & USER MANAGEMENT

- Hierarchical segmentation

- Joint CIF management

- Multi-user enablement

- CIF to CIF relationships

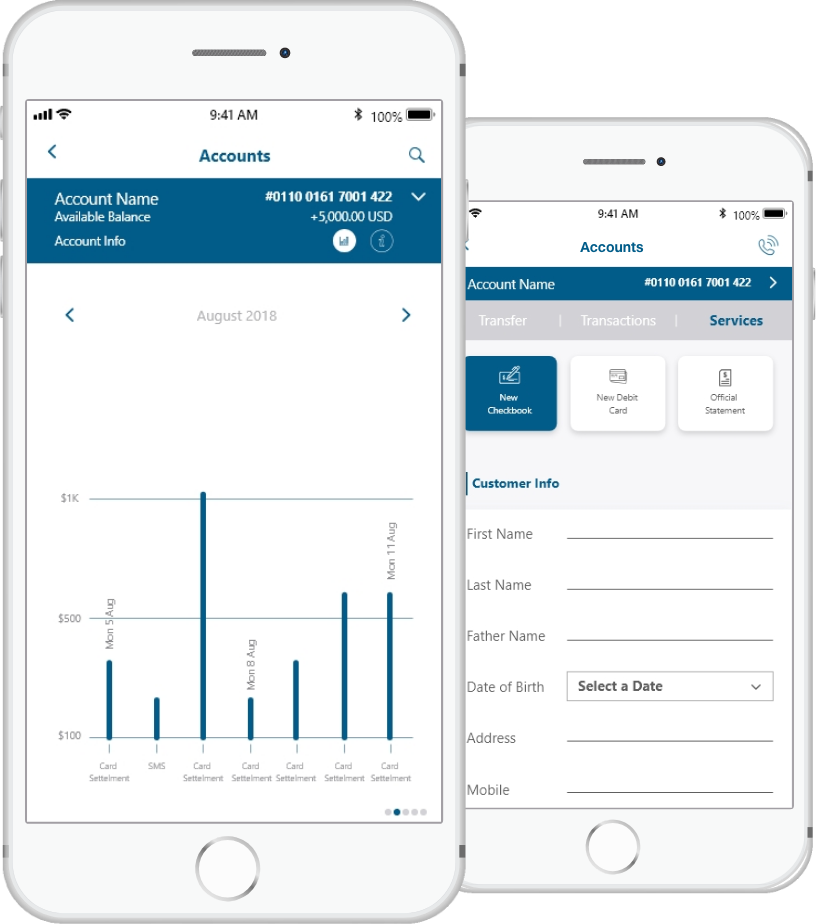

PRODUCTS & TRANSACTIONS

- Aggregated balances and financial statement (current, savings, debit and credit and credit cards, loans)

- Account/card summary and details

- Big data transaction repository for analytic and reporting

- Transaction detail view

- Completed and pending transactions

- Loyalty reporting and visibility

- Applicable service requests per product type

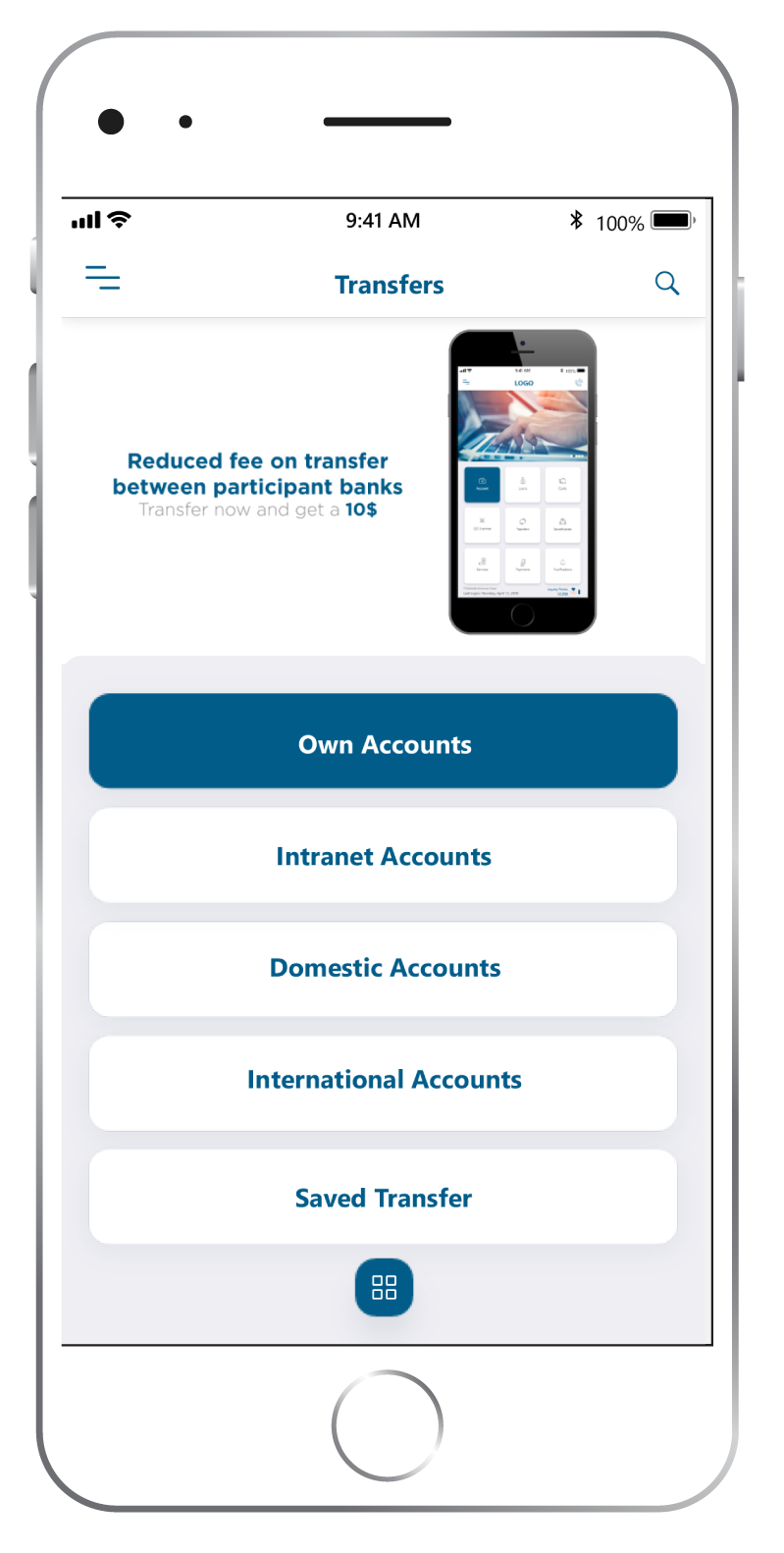

FINANCIAL TRANSFER

- Own account transfer

- Internal bank transfer

- Local and international transfers

- Standing orders

- Bill payment and recharge services

- Payment templates

- Beneficiary management

- Strong customer authentication (SCA) to sign the transaction for ultimate security

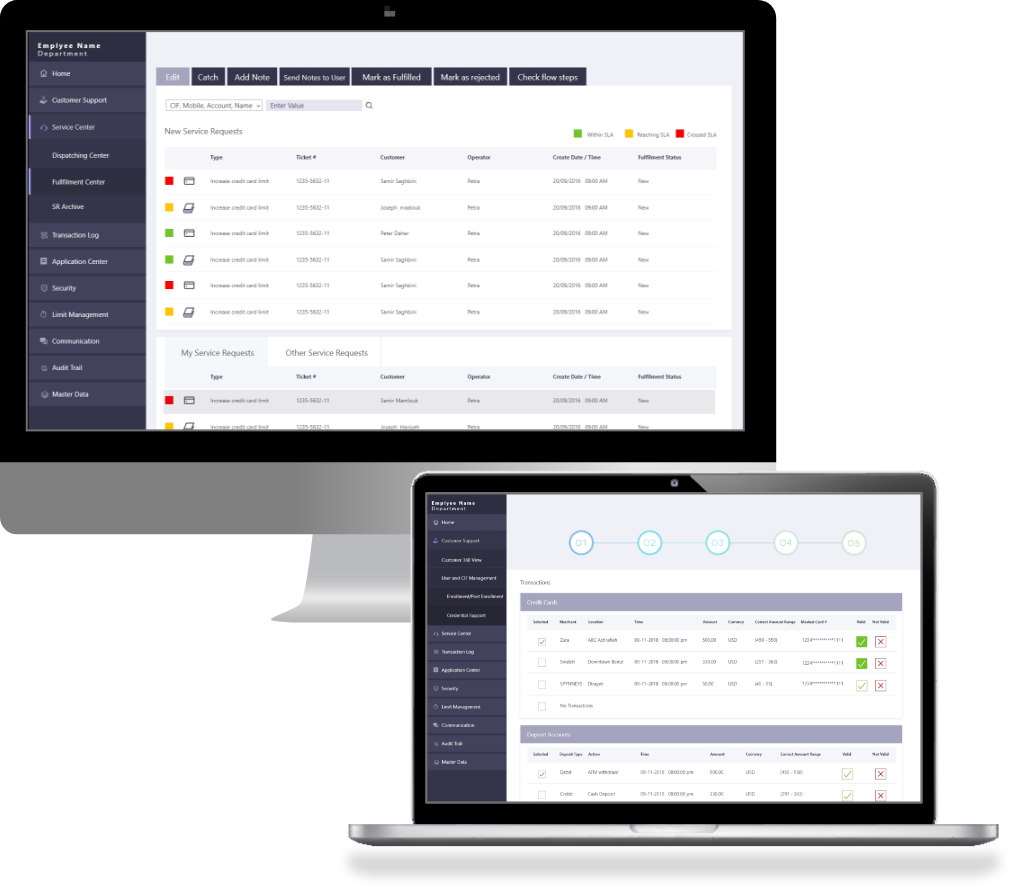

SERVICE REQUEST

- Offline request management

- Straight-through-processing when applicable

- Dispatcher and fulfillment center workflow management

- Easy configuration and management for various service requests

COMMUNICATION CENTER

- Secure messaging (inbox)

- Personalized in-app notifications web and mobile

- Bulk notification per segment/product type

- Personalized notification settings

- Event based notification: upon salary domiciliation, upon credit interest, check deposit, utilities and bills, etc.

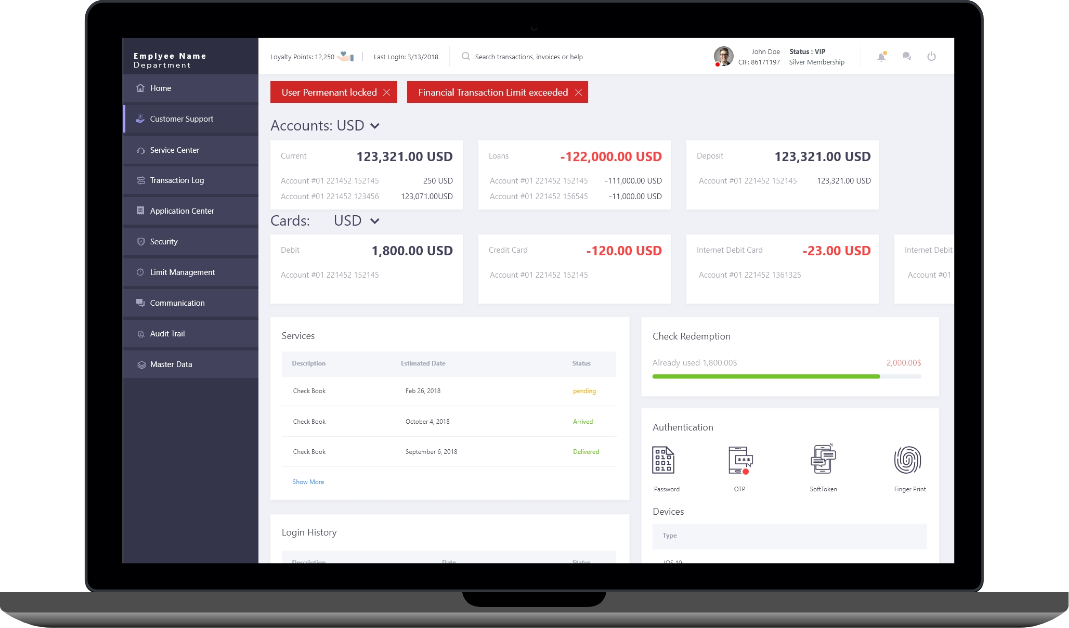

IDENTITY AND SECURITY MANAGEMENT

- Identity empowered with single sign-on capability across all channels

- Login with various method: password, pin, fingerprint, and OTP

- Multi-factor authentication (MFA) for login and transaction signing empowered with OTP and enabled mobile device soft tokens (same as Google authenticator)

- Easy self-password recovery process

- Access control: grant access to the right person, with the right permissions, and the right time

- Secure authentication and authorization based on Oauth 2.0 and OpenID connect protocols

RISK MANAGEMENT

-

Financial limits

- - Number of transactions per day/week/month

- - Total amount of transactions per day/week/month

- - Etc…

- Audit trails for customer and staff activities

CUSTOMER SUPPORT CENTER

- Customer 360 view

- Enrollment management

- Customer identification process

- Credential management

- Personalized recommendations